Payroll software is a low-priced, automated, often turnkey management solution for everything from employee payments to human resources, benefits and taxes. Scalable platforms like Gusto and QuickBooks are ideal for small and midsize businesses that don’t necessarily have the fiscal wherewithal to onboard an entire HR department but need flexibility when it comes to handling all things HR. Also, nothing against carbon-based AI (people), but these frameworks are great for avoiding a major pain point: human error.

SEE: Best payroll software for your small business in 2022 (TechRepublic)

Two of the top software-as-a-service payroll options are Gusto and Intuit’s QuickBooks — both flexible, scalable and based on a subscription model with several pricing tiers. Gusto is ideal for small companies looking for ease of use and versatility, and QuickBooks Online is good for businesses up to midsize firms that likely have in-house bookkeeping and accounting.

Jump to:

What is Gusto?

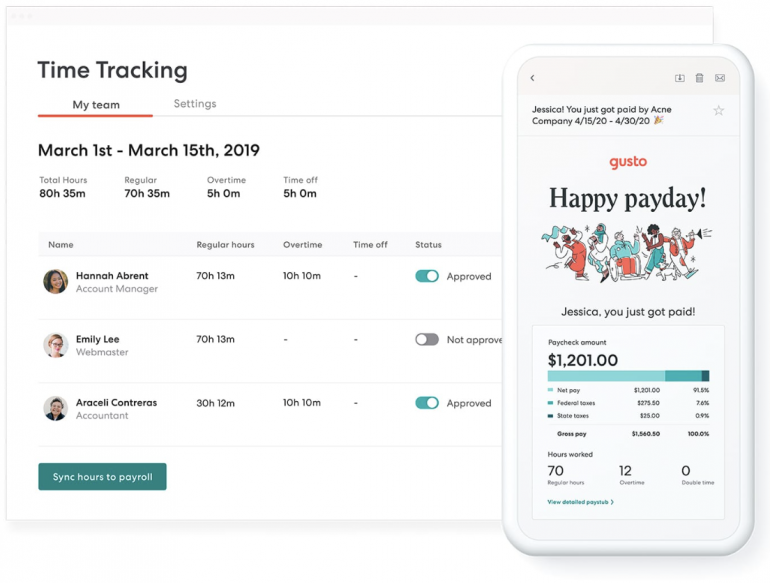

Gusto‘s payroll management software is great for businesses with 10–20 employees. It automates a range of payroll functions, from easy to complex, both for employees and contractors. The framework also handles a plethora of HR tasks, including budget-based disability insurance coverage and employee dental insurance.

Gusto also has the ability to expedite tax filing and reporting requirements, time tracking, expense tracking, scheduling shifts and employee onboarding. Importantly, no domain experts are required. Because of ease of use and setup, it’s ideal for companies with no or new payroll managers.

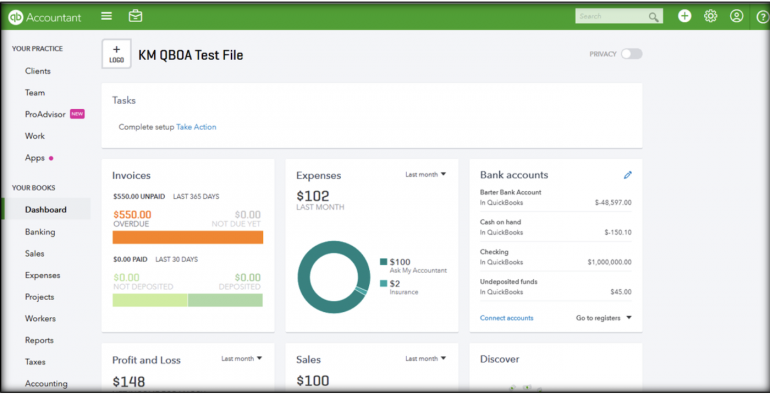

What is QuickBooks?

QuickBooks by Intuit is a scalable product for inventory, payroll, benefits, taxes and time tracking and much more. It has several pricing tiers for its QuickBooks Online SaaS packagers, including its most popular Simple Start, Plus and Advanced versions, but also (still) sells locally-hosted desktop versions (Desktop Plus and Pro). The core product, QuickBooks Online Plus, includes :

- File access for two accountants

- Advanced invoicing, payroll, cash flow management, tax category features and more

- Access to clients accounts

It’s definitely a good option for companies with dedicated bookkeeping and accounting.

Gusto vs. QuickBooks: Feature comparison

| Features | Gusto | QuickBooks |

|---|---|---|

| Built-in expense tracking | No | Yes |

| Time tracking | Yes | Yes |

| Best with bookkeeping skills | No | Yes |

| Mobile friendly | Yes | Yes |

| Installation friendly | Yes | Less so |

| Submits state, federal and local taxes | Yes | Yes |

| Offers free trial period | No | Yes |

Cloud-based vs. desktop software

There are locally-hosted desktop versions of several payroll software packages available, but the trend is definitely toward cloud-based SaaS, which follows and complements the shift to remote and hybrid work. The major benefit: you can access cloud-based platforms anytime and anywhere as long as you have internet access, and they are more cost-effective, scalable, easier to get up and running, and ideal for the requirements of smaller businesses.

Terrestrial products can only be accessed from the computer on which it was installed. Gusto does not have a locally-hosted product, and while QuickBooks Desktop SKUs are still available for a yearly subscription price (about $800 per year for its Desktop Premier Plus), the company is sunsetting QuickBooks Desktop in 2023.

Pricing tiers and add-ons

The price of entry is relatively low for both Gusto and QuickBooks, but add-ons add up. Gusto starts at $39 per month and an additional $6 for every employee enrolled in the software. But, the addition of features like multi-state payroll, custom onboarding templates, time tracking, next-day direct deposit and PTO management bumps it up to $80 per month and $12 per user.

QuickBooks’ entry tier is Simple Start, at $30 per month, for just a single user. Add two more users plus bill management and time tracking, and the price bumps up to $55. Five users, plus project tracking and inventory tracking is $85 per month.

International or local only?

While a growing number of companies in the U.S. have employees and contractors overseas, some payroll and accounting products are home alone, with no ability to facilitate payments from other countries, which requires a separate payroll framework.

QuickBooks handles overseas transactions. By comparison, Gusto supports international contractor payments in its “contractor-only” plan via Remote Team but only after a domestic contractor has been added, according to the company.

SEE: Quick Glossary: Cloud Platform Services (TechRepublic Premium)

Integration with other software

Not all automated payroll software products do it all. Some, for example, do not do accounting and billing, making ease of integration with other products key. While Gusto doesn’t expedite accounting or billing, it does integrate with many applications, including QuickBooks, Xero, FreshBooks, Jirav, Sage and many more, to do things like training, record keeping and performance reviews.

QuickBooks is easily integrated with other apps and Intuit’s own products like Mailchimp, which allows users to sync marketing and financial data to a specific Mailchimp audience for targeted marketing.

SEE: What is Software as a Service? (TechRepublic)

Choosing between Gusto and QuickBooks

It’s not all about the cost, although budget is part of the process. Both Gusto and QuickBooks offer low-cost entry tiers and core products, but when you consider upgrades and additional features, the prices can rise sharply.

All said, if you are a contractor with 10 employees, Gusto will probably be right for you, as it fits a smaller budget and fewer employees. Because it’s online, it lets users pay a monthly subscription fee rather than an upfront fee and offers a secure logon via a web browser. It also includes features like automated charitable donations and virtual wallets to help employees manage their finances. Plus, there’s built-in free checking and high-yield savings accounts with paycheck advance for employees.

QuickBooks, which is more appropriate for the midsize companies — its clients range from Gruhn Guitars to the University of Massachusetts at Amherst — offers industry-specific editions, purchasing and vendor management and sales and expense forecasting tools.

Of note, users of QuickBooks Desktop will lose security updates, live support, online backup, banking and other services as of June 2023, so this might be a good time to get with the cloud.