As data centers, hybrid cloud, edge and processing power become top priorities, the two firms present new technologies. Discover what they can do, the market and trends.

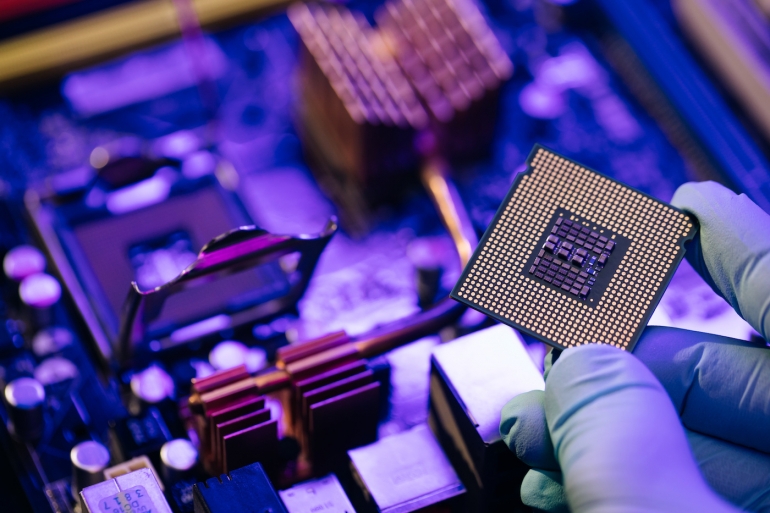

Cisco and Intel, building on nearly two decades of partnership, presented new servers powered by the next generation of Intel Xeon processors. On Jan. 10, both companies simultaneously announced the products. Intel unveiled the 4th Gen Intel Xeon Scalable processors, while Cisco introduced the new flexible, more powerful and sustainable servers based on Intel innovation.

Cisco’s new servers, the 7th Gen UCS X-Series and C-Series Servers, leverage the X-Series’ future-ready and modular compute architecture. The company explains that the expansion of the portfolio is designed to meet the global demands of companies on the digital transformation and acceleration journey.

The new products include new rack servers and X-Series Modular Compute Nodes based on 4th Gen Intel Xeon Scalable CPUs with support for DDR5, PCIe 5.0, Compute Express Link 1.1 and new Intel accelerators.

Jump to:

The new UCS C-Series and X-Series: What they can do

The Cisco seventh generation of UCS C-Series and X-Series servers aim to provide customers with more flexibility and performance. The two new servers deliver application deployment and acceleration supported by the Intel data center graphics processing unit with UCS X-Series Fabric technology.

As more and more companies move business-critical operations to data centers, hybrid clouds and edge centers, servers and processors evolve to cope with the new demands. Industrial Internet of Things, networks, artificial intelligence, machine learning and digital twins are all leading trends in investing in technology. Companies need to do more with less — require the tools to scale or pivot with fluctuating demands and unexpected disruptions.

SEE: Artificial Intelligence Ethics Policy (TechRepublic Premium)

“Today’s extreme compute demands require modern IT infrastructure and operations designed to accelerate performance across the fastest-growing workloads that businesses depend on,” said Lisa Spelman, corporate vice president and general manager of Intel Xeon Products.

Data center modular architectures allow enterprises to scale while new processors drive the necessary computing power that trends like the fourth industrial revolution requires. Cisco builds on the modular architecture of its UCS X-Series by continuing to disaggregate technologies and eliminate historical forced upgrades and forklifts when adopting new technologies.

The new services can support 2-socket and 4-socket, M6 and M7 generation compute nodes, and a variety of GPU nodes all in the same chassis. This enables UCS to support technologies such as DDR5, PCIe 5.0, Compute Express Link 1.1 and now the Intel Data Center GPU Flex Series. Powered and managed by Intersight, the UCS X-Series can support workloads on a blade-server architecture that has historically been only practical on rack-based servers.

Key features of the new Cisco servers include:

- Reduction of the number of systems.

- Up to a four-to-one consolidation ratio reduction compared to previous generations.

- Support for more and newer types of workloads.

- Ability to reduce components, devices and cabling through the new UCS X-Series Fabric architecture.

- 64% increase in performance and 31% in energy reduction compared to previous models.

- Integration with Cisco Intersight for sustainability management and policies.

IT’s top-of-mind concerns: Market and challenges

The need to modernize infrastructure, increase performance and run heavy workloads while leveraging AI, ML and virtual desktop infrastructure continues to fuel the transformation and evolution of cloud, edge and data center technologies. Cisco and Intel explained that the new products will help enterprises adapt to the dynamic workloads. The companies also designed the offering with IT and business priorities in mind.

Balancing security and ESG initiatives with digital transformation

The trend for companies to digitally transform shows no sign of slowing down. A recent Forrester report commissioned by Bounteous found that failure to transform digitally translates into revenue growth impact, return on investment and a company’s bottom line. More than half, 66% of companies surveyed, said they are transforming to have the agility needed to meet the demands of customers, workforces and the environment.

Transformation is also critical for organizations to meet environmental, social and governance standards. The regulatory data landscape continues to increase in complexity with new laws appearing internationally. Consumers and business partners are closely looking at how companies manage data. Under this spotlight, cyberattacks are accelerating globally, further expanding data security pressures.

SEE: Top 5 benefits of applying ESG standards to your business (TechRepublic)

On the other hand, processing more data requires more energy. This energy-paradox can block development, especially for companies committed to net-zero goals or tracking their carbon emissions and working under energy optimization programs. The data center hardware industry is well aware of modern ESG demands and develops new technology accordingly.

Cisco reckons that while the new servers enable organizations to operate and run AI, ML and big data, with high-computing powers, security and sustainability are not compromised. The company cites Gartner’s Top 10 Strategic Technology Trends for 2023, which lists sustainability as its top priority, noting that companies must “invest more in innovative solutions that are designed to address ESG demand to meet sustainability goals.”

Cisco and Intel face tough competition in the global data center market

But, Cisco is not the only big player in the global market. The company faces strong competitors like Lenovo — which, as TechRepublic reported in September 2022, announced the broadest portfolio of products in its history.

The Global Data Center IT Infrastructure Market and Forecast report of Global Data valued the industry at $211.9 billion in 2021 with an expected growth at a compound annual growth rate of 6.2% until 2026. The increase in data generation and the evolution of data centers as well as investments in public cloud are driving the sector, the report states.

IBM, Hewlett Packard Enterprise, Huawei and Dell have substantial positions in the market. Additionally, top cloud vendors like Amazon Web Services, Microsoft Azure Cloud and Google Cloud Platform continue to invest millions in research and development, influencing and defining innovation and new products.

Despite the strong competition, Cisco consumer perception ranks high. Aggregated review sites, like Gartner Peer Insights, show positive reviews and comparisons for the company’s products and services.

Cisco and Intel continue to progressively evolve the next generations of server hardware and computing processing technology as the future of data centers continue to take shape. Users should expect new data center products and services to be unveiled throughout 2023, pushing the limits of performance and operational efficiency, while the business world focuses on automation and intelligent analytics.

In terms of other cloud matters, Intel revealed in September 2022 it was targeting “true magicians” with its developer cloud launch, while in June 2022 Cisco unveiled sweeping new cloud capabilities, SASE and WAN forecasting offerings.